What is Compa-Ratio? How It Guides Pay Decisions

Understanding Compa-Ratio helps companies make fair, defensible pay decisions. Learn how to use compensation philosophy, salary ranges, and data to guide pay.Making fair and competitive pay decisions doesn't have to be complicated. Whether you're setting a new hire's salary, reviewing raises, or explaining compensation to managers, understanding a few core concepts will help you build a transparent compensation program.

This guide walks you through the building blocks: compensation philosophy, salary ranges, and compa-ratios - and shows you how to use them to make defensible pay decisions.

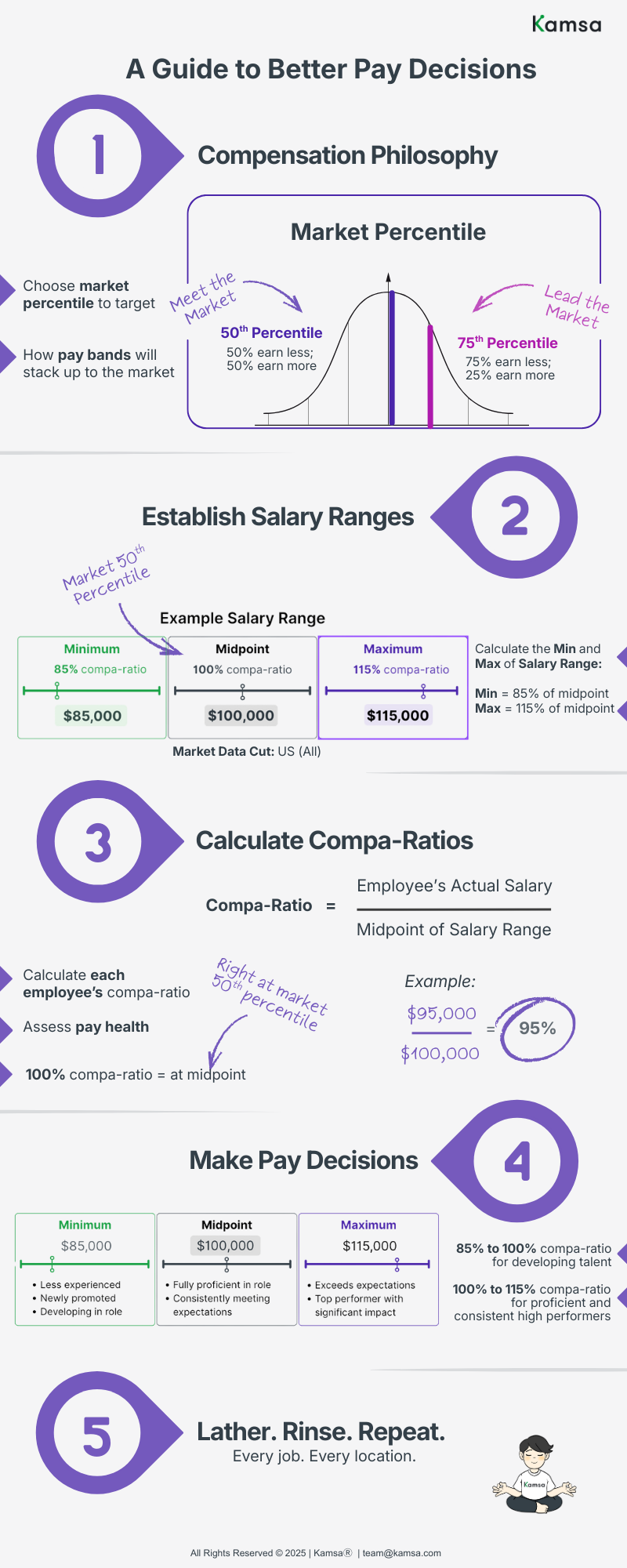

Decide On Compensation Philosophy

Before you can set salaries, you need to decide where you want to position your company in the market. Do you want to meet the market or lead it?

Your compensation philosophy answers that question. It defines your organization's approach to pay and ensures your practices align with your values, culture, and business goals. At the heart of this philosophy is the market percentile - a benchmark that reflects how your pay compares to other companies.

If you target the 50th percentile, you’re choosing to pay at the middle of the market, meaning 50% of companies pay more and 50% pay less. Targeting the 65th or 75th percentile means you intend to pay above most employers to stay more competitive. Your chosen market percentile becomes the anchor for your salary ranges and determines where your midpoints sit, guiding how you position pay for each role.

For example, you might choose to:

- Target the 50th percentile (meet the market) for most roles

- Target the 65th or 75th percentile (lead the market) for hard-to-fill or business-critical positions

This decision isn't one-size-fits-all. Many companies customize their approach by job family. For instance, you might target the 75th percentile for Software Engineering roles where competition for talent is fierce, while targeting the 50th percentile for Accounting roles where talent is more readily available.

A clear compensation philosophy provides clarity for employees and empowers People and Finance teams to confidently navigate pay-related decisions, from setting salary ranges to explaining adjustments.

Establish Salary Ranges

Once you've chosen your market positioning, use market data to build salary ranges. Reliable compensation surveys like Kamsa’s proprietary database aggregate salary data by location, job family and job level - giving you the benchmarks you need.

Here's how it works:

1. Obtain Market Data

Use compensation data from sources that validate their data. Quality matters - you want data that's been reviewed and confirmed, not crowdsourced information that may be outdated or inaccurate.

Look for data available across all the countries where you have employees, with the ability to filter by job family and job level - and ensure you're comparing your roles against truly comparable organizations with similar industries and company sizes.

2. Set the Midpoint

The midpoint of your salary range represents your chosen market percentile. If you've decided to target the 50th percentile for a Financial Analyst role, that becomes your midpoint. For a Software Engineer role where you're targeting the 65th percentile, that higher benchmark becomes the midpoint.

3. Apply Geographic Adjustments

Market data should reflect cost-of-living and cost-of-labor differences by location. A Financial Analyst in San Francisco will have a different range than one in Chicago, even if both are at the 50th percentile for their respective markets. Similarly, you might use London-specific data for employees in the capital versus UK-wide data for those in other cities.

4. Determine the Range Spread

Build flexibility around the midpoint to account for differences in experience and performance:

- Minimum: Typically 85% of the midpoint

- Maximum: Typically 115% of the midpoint

For example, if your midpoint for an IC3 Financial Analyst is $100,000:

- Minimum: $85,000

- Maximum: $115,000

Calculate Compa-Ratios

The compa-ratio is a simple equation that tells you how an employee's actual pay compares to the midpoint of their salary range:

Employee's Actual Salary ÷ Midpoint of Salary Range = Compa-Ratio

A compa-ratio of 100% means the employee is paid exactly at the midpoint. A ratio of 90% means they're paid 90% of the midpoint (closer to the minimum), while 110% means they're paid above the midpoint (closer to the maximum).

This metric is used for assessing pay health across your organization and making informed decisions about individual salaries.

Make Pay Decisions Within the Range

So where should an employee fall within their salary range? Here's a practical framework:

Below 85% (Below the Minimum)

This is a red flag. Employees paid below the minimum of their range may feel undervalued and are at risk of leaving. This typically requires immediate attention.

85% - 100% (Minimum to Midpoint)

This is appropriate for employees who are:

- New to the role

- Recently promoted and still growing into the position

- Meeting expectations but not exceeding them

- Still developing the full skillset required

100% - 115% (Midpoint to Maximum)

This range is appropriate for employees who are:

- Highly experienced in the role

- Consistently exceeding expectations

- Demonstrating advanced skills or taking on additional responsibilities

- Top performers you want to retain

Above 115% (Above the Maximum)

Employees paid above the maximum may be overcompensated relative to market. This can happen with long-tenured employees or after market shifts. While not always a problem, it limits your ability to give meaningful raises and may indicate the employee is ready for a promotion or role change.

Ensure Pay Equity

As you make pay decisions, don't forget to check for internal equity. Are employees in similar roles with similar experience and performance paid consistently?

Displaying your internal average alongside market data makes it easy to spot discrepancies and ensure fairness.

Review Regularly

Salary ranges should be reviewed at least annually to ensure they're meeting your retention goals, staying aligned with market rates, and reflecting the true value of each role.

Some positions - especially in fast-moving fields - may require more frequent reviews.

Building a fair, competitive compensation program comes down to three steps:

- Define your compensation philosophy – Decide where you want to position your company in the market, and customize by job family if needed.

- Build salary ranges using reliable market data – Set midpoints based on your target percentiles, apply geographic adjustments, and create ranges that allow for growth.

- Use compa-ratios to guide individual pay decisions – Position employees within their ranges based on experience, performance, and market conditions, and review regularly to maintain equity and competitiveness.

The Impact

When you have a clear framework and quality data, pay decisions become clear, defensible, and aligned with your organizational goals. And perhaps most importantly, they become easier to explain to managers and employees - creating the transparency and trust that are essential to a healthy compensation program.